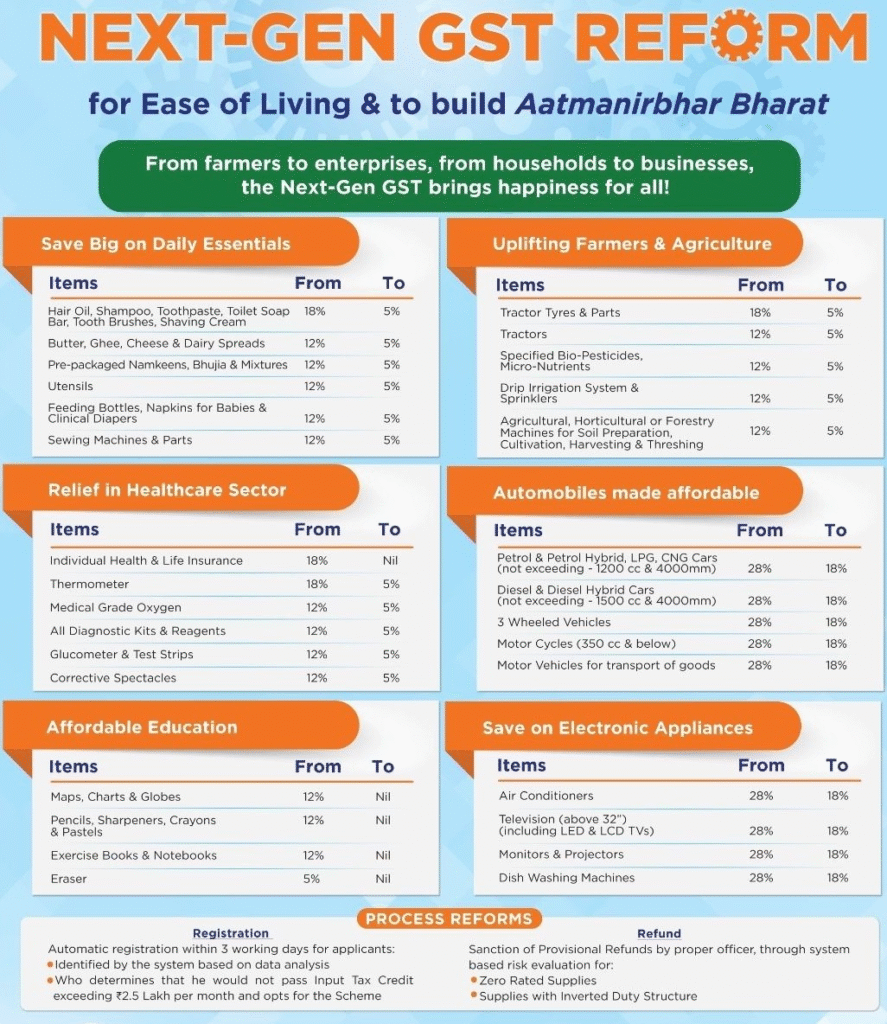

In a watershed moment for India’s tax structure, the Goods and Services Tax (GST) Council approved a comprehensive overhaul, slashing rates on daily essentials, personal insurance premiums, and other common-use items to boost household demand. The landmark reform shifts the GST regime away from the current four slabs to a simpler two-slab structure of 5% and 18%, effective from September 22, 2025. Finance Minister Nirmala Sitharaman chaired the decisive council meeting where these pivotal changes were announced.

“These reforms have been crafted with the common man in mind,” said Sitharaman, emphasizing the government’s intent to spur consumption and ease regulatory burdens. The council’s new GST 2.0 system abolishes the 12% and 28% slabs, streamlining taxation and potentially lowering prices on goods ranging from hair oil and soaps to televisions and small cars. Most notably, health and life insurance premiums will now attract a nil GST rate, a significant relief likely to increase insurance affordability and penetration across India.

Industry leaders welcomed the move as timely and growth-oriented. Rajiv Memani, President of the Confederation of Indian Industry (CII), hailed it as “a reform that will be remembered for its clarity, inclusiveness, and balance,” noting how the targeted rate cuts will “spur demand at a time when boosting household purchasing power is critical.”

The council also introduced a special 40% tax slab on luxury and sin goods such as high-end cars, tobacco, and carbonated drinks to balance revenue needs. Household appliances like air conditioners and refrigerators will see tax reductions from 28% to 18%, while essential healthcare products including certain medicines and diagnostic kits will come under lower tax brackets, some even exempted.

Implementation of the reform coincides with the upcoming festive season, expected to amplify consumer spending and stimulate economic recovery amid global uncertainties. The Finance Ministry projects a net fiscal impact of approximately Rs 48,000 crore, which is likely to be offset by enhanced compliance and economic activity.

Moving forward, GST 2.0 aims to simplify compliance, increase ease of doing business, and strengthen India’s consumption base, positioning the country for sustained growth in an evolving global landscape.